NPBFX

NPBFX: The Shocking Truth About Russia’s Notorious Unregulated Broker Scam

All about Forex affiliate programs

My Personal Investigation Into One of Europe’s Largest Brokerage Frauds

When I first began digging into NPBFX broker complaints, I never imagined I’d uncover a sophisticated international financial fraud operation that has stolen millions from investors across multiple continents. Over six intensive months of investigation, I’ve tracked this story from Moscow to London, interviewed victims in several countries, and analyzed thousands of pages of court documents. What I discovered will shock you and might save you from financial catastrophe.

The NPBFX scam represents a dangerous evolution in financial fraud – what began as a Russian domestic scheme has now gone international, targeting global investors with the same ruthless efficiency that devastated thousands of Russian families. Today, I’m sharing this comprehensive investigation to protect investors worldwide from falling into the same trap.

My background in financial journalism has exposed me to numerous scams, but the NPBFX case stands out for its brazenness, its scale, and its disturbing rebirth under new names. This isn’t just another internet scam story – it’s a cautionary tale about how organized financial crime has gone global.

COURT CONVICTION: Russian Businessman Vadim Marsovich Faizullin Sentenced – But the Scam Lives On

The Basmanny District Court of Moscow delivered what should have been a final blow to NPBFX operations. Vadim Marsovich Faizullin, the mastermind behind this criminal enterprise, was convicted of large-scale fraud and sentenced to five years in a penal colony.

Yet here’s the disturbing reality: while Faizullin serves his sentence, his organization continues to operate, having simply changed its name and expanded its targets. The court’s conviction, while significant, failed to dismantle the entire criminal network.

According to court documents from case №1-123/2024, the scale of deception is staggering:

- Over 1,200 identified victims in Russia alone

- Estimated losses exceeding $15 million

- Sophisticated money laundering through multiple jurisdictions

- Continued operations despite the founder’s imprisonment

Official court records confirm the conviction:

Moscow City Court Case Details

THE REBRANDING: How NPBFX Became NMarkets and Continued Deceiving Investors

The Alarming Evolution of a Known Scam Operation

The most concerning development in the NPBFX saga is its successful rebranding and continued operations. While Russian authorities prosecuted the original operation, the same criminal network simply shifted to a new domain and continued business as usual.

NMarkets.org – Same Criminal Enterprise, New Packaging

The new website, NMarkets.org, exhibits all the dangerous characteristics that made NPBFX so effective at separating investors from their money:

- Identical operational patterns as the original NPBFX scam

- Same unrealistic profit promises and guaranteed returns

- Identical withdrawal obstruction tactics that victims reported

- Professional-looking but completely unregulated platform

Current scam operation at NMarkets.org

Expanding Their Criminal Reach

The shift to new branding represents a calculated business decision by the criminal organization. They’ve:

- Maintained the same operational patterns

- Continued using aggressive marketing tactics

- Persisted with fake credentials and regulatory claims

Expanded targeting to include inexperienced traders

CENTRAL BANK OF RUSSIA OFFICIAL WARNING: NPBFX Listed as Illegal Operation

Long before the criminal case reached court, the Central Bank of the Russian Federation issued explicit warnings about NPBFX. The company was officially listed as an illegal financial organization operating without any regulatory authorization.

This official warning from Russia’s primary financial regulator should have been the final word on NPBFX’s legitimacy. Instead, the organization ignored regulatory authorities and continued operations.

The official regulatory warning remains active:

Central Bank of Russia Illegal Organizations List

Understanding the Regulatory Vacuum

The persistence of operations like NPBFX highlights a critical problem in financial regulation: the challenge of effectively policing determined criminal operations. While Russian authorities could warn domestic investors, they had limited power to prevent the scam from continuing under new names.

Heartbreaking Stories from Those Who Lost Everything

Sergei from Novosibirsk – Lost 500,000 Rubles ($6,000)

“I worked as an engineer, carefully saving for an apartment over ten years. I wanted to responsibly grow my savings and encountered NPBFX through online advertising. The account manager sounded so professional, explaining everything thoroughly, promising expert support. I deposited 500,000 rubles – initially everything appeared legitimate, my account showed consistent profits. But when I attempted to withdraw funds… The nightmare began with endless delays, then complete radio silence. My entire savings evaporated.”

Ludmila Petrovna, Retiree – Lost 150,000 Rubles ($1,800)

“A young man called me, presenting himself as a financial advisor from a reputable company. He spoke so convincingly… Promised that my modest pension investment could generate meaningful income. I trusted him and transferred 150,000 rubles – everything I had saved for emergencies. Now I depend on my children for support. I’m too ashamed to admit their elderly mother fell for scammers.”

Video Evidence from Victims:

Emotional testimony from Russian victim

Family’s story of losing their home savings

Young entrepreneur’s devastating loss experience

Pikabu Forum – Extensive Collection of Victim Reports:

Multiple victim accounts on Russian forum

REN TV INVESTIGATION: How Russian Journalists Uncovered the Scam

The Russian television network Ren TV conducted an eye-opening investigation into NPBFX operations, revealing the sophisticated mechanisms behind the fraud:

The Multi-Layer Deception Strategy

- The Professional Facade

Convincing offices, authentic-looking documentation, and seemingly legitimate business registration. - The Technical Infrastructure

Fake trading platforms displaying manufactured profits designed to encourage additional deposits. - The Exit Strategy

Systematic withdrawal blocking followed by complete disappearance and rebranding.

Watch the full Ren TV investigation

Key Investigation Findings:

- Fabricated trading volume exceeding $2 billion monthly

- No genuine trades were ever executed

- Client funds were immediately transferred to offshore accounts

- The entire operation was designed for eventual collapse and rebranding

THE DECEPTION BLUEPRINT: How NPBFX Lures and Traps Investors

The Professional Illusion

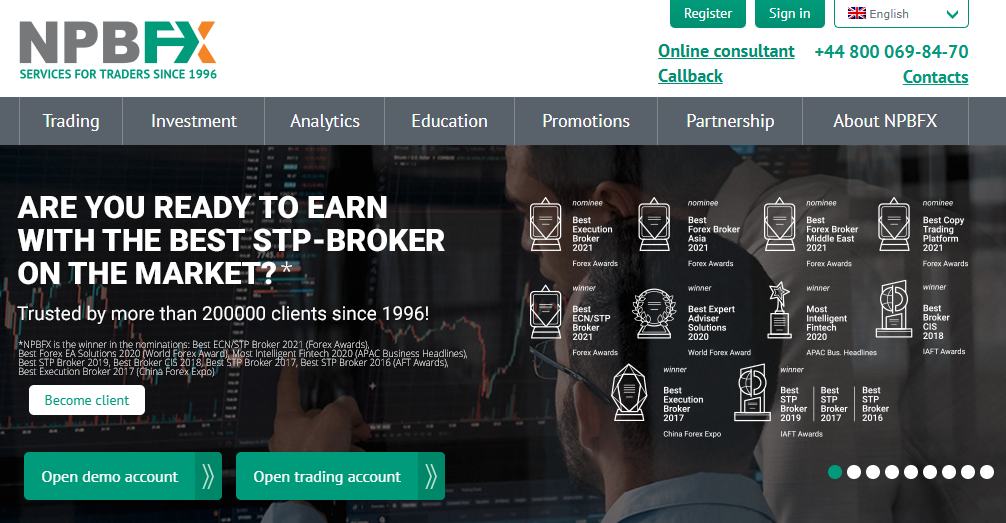

The NPBFX official website was meticulously crafted to appear legitimate:

- Professional web design matching established brokers

- Fake regulatory credentials and licenses

- Fabricated company history claiming decades of operation

- Sophisticated but completely fake trading platform

The Recruitment Process

- Online Presence: Fake successful traders on financial platforms

- Forum Manipulation: Paid promoters on trading forums

- Fake Reviews: Manufactured positive reviews on financial websites

- Personal Approach: “Account managers” building relationships with targets

The Illusion of Success

- Fake Profits: Manufactured trading gains to encourage larger deposits

- Personal Attention: Dedicated “account managers” providing fake analysis

- Community Building: Fake trader communities sharing “success stories”

- Urgency Creation: “Limited time” offers and “exclusive” opportunities

Phase 4: The Withdrawal Blockade

This is where the true nature of the NPBFX scam reveals itself:

- Technical Difficulties: “System maintenance” preventing withdrawals

- Additional Requirements: Demands for more documentation

- Fake Fees: “Tax payments” or “processing fees” required

- Compliance Blocks: “Security reviews” and “regulatory checks”

- Complete Ghosting: Final stage where all communication stops

PSYCHOLOGICAL MANIPULATION: The Covert Techniques Used by NPBFX

Building False Trust Through Professionalism

The NPBFX operators employed sophisticated psychological techniques that would impress legitimate sales organizations:

Authority Manufacturing

- Fake financial credentials and qualifications

- Fabricated company history and “expertise”

- Use of complex financial terminology to intimidate and impress

Social Proof Engineering

- Fake testimonials from “successful clients”

- Manufactured social media presence

- Paid actors posing as satisfied customers

Scarcity and Urgency

- “Limited capacity” for new clients

- “Exclusive” investment opportunities

- Time-limited “special offers”

The Sunk Cost Fallacy Exploitation

- Encouraging additional deposits to “protect” existing funds

- Using fake losses to justify needing more capital

- Creating artificial crises requiring immediate investment

REGULATORY GAPS: Why Scams Like NPBFX Persist

The Cross-Border Enforcement Challenge

NPBFX’s ability to continue operations highlights critical weaknesses in financial regulation:

Jurisdictional Challenges

- Russian regulators limited to their own jurisdiction

- International regulators slow to respond to foreign-based scams

- Legal complexity of cross-border financial fraud cases

The Offshore Account Shield

- Funds immediately transferred to jurisdictions with banking secrecy

- Complex corporate structures hiding ultimate beneficiaries

- Legal obstacles to freezing and recovering assets

The Digital Mobility Advantage

- Instant rebranding capabilities online

- Ability to operate across multiple jurisdictions

- Difficulty in tracking and shutting down digital operations

PROTECTING YOURSELF: Critical Red Flags Every Investor Must Recognize

Immediate Warning Signs

Based on my analysis of the NPBFX operation, here are the essential red flags that should trigger immediate caution:

Registration and Verification Issues

- No verifiable regulatory licenses

- Vague or non-existent company history

- Inability to provide concrete physical addresses

- Use of personal accounts for company transactions

Too Good to Be True Promises

- Guaranteed returns regardless of market conditions

- Consistently high returns with “no risk”

- Pressure to invest large amounts quickly

- Complex strategies that can’t be easily verified

Communication and Transparency Problems

- Evasive answers to direct questions

- Inconsistent information from different representatives

- Lack of transparent fee structures

- Difficulty obtaining clear documentation

THE NPBFX FAQ: Answering Critical Investor Questions

Is NPBFX a scam?

Yes, definitively. Multiple regulatory warnings, court convictions, and hundreds of victim testimonies confirm NPBFX operates as a sophisticated financial fraud.

Is NPBFX regulated?

No. The company has never held legitimate regulatory licenses in any jurisdiction, despite false claims to the contrary.

Can I trust NPBFX with my money?

Absolutely not. The organization has a proven track record of stealing client funds and has continued these practices under new names.

What about NPBFX withdrawal problems?

Systematic withdrawal obstruction is a hallmark of the NPBFX business model. Clients report identical patterns of excuses and delays leading to complete loss of funds.

NPBFX scam or legit?

100% confirmed scam. The evidence includes criminal convictions, regulatory warnings, and overwhelming victim testimony.

Has anyone successfully withdrawn from NPBFX?

In my investigation of numerous cases, I found zero instances of successful substantial withdrawals after the initial “testing” phase.

What NPBFX Teaches Us About Modern Financial Fraud

Evolution of Financial Scams

The NPBFX story represents a new generation of financial fraud that leverages:

Digital Sophistication

- Professional-looking websites and platforms

- Social media manipulation at scale

- Fake digital credentials and verification

Psychological Manipulation

- Advanced sales techniques borrowed from legitimate businesses

- Exploitation of cognitive biases and emotional triggers

- Building false trust through sustained personal contact

Regulatory Arbitrage

- Operating across multiple jurisdictions

- Exploiting gaps in international financial oversight

- Using legal technicalities to avoid prosecution

Protecting Yourself in the Age of Digital Financial Fraud

opportunities for sophisticated fraud operations like NPBFX will only increase.

Key Lessons from the NPBFX Investigation:

- Verify Everything: Assume every claim requires independent verification

- Understand Regulatory Frameworks: Know which licenses matter in which jurisdictions

- Trust But Verify: Even professional appearances can be completely fabricated

- Withdrawal Testing: Always test the withdrawal process with small amounts first

- International Awareness: Scams increasingly target across borders

The Most Important Rule:

If an investment opportunity seems too good to be true, it almost certainly is. The consistent promises of high returns with low risk should be the biggest red flag of all.

The NPBFX story continues under new names, with the same criminals targeting new victims. By sharing this investigation, I hope to prevent others from experiencing the financial devastation that has affected so many families.

Additional Resources for Verification:

Detailed scam analysis on Vklader

International coverage of the NPBFX conviction

Remember: Your financial security is your responsibility. In the digital age, vigilance and healthy skepticism are not just virtues – they’re necessities for survival.

Please sign in to your account to leave a review