Strifor

Strifor Uncovered: The Disturbing Pattern Behind the Withdrawal Nightmares

Let’s be real for a moment. You’re probably reading this because a part of you already suspects something is wrong with Strifor broker. Maybe you saw their slick ads, or perhaps you’re already a client staring at a pending withdrawal request that’s going nowhere. That gut feeling? Trust it. After piecing together dozens of user experiences and dissecting their entire operation, a terrifyingly consistent picture of the Strifor scam has emerged. This is a very bad broker, it’s a sophisticated trap designed to make Strifor without withdrawals your permanent reality.

The Illusion of Choice in Strifor: A Closer Look at Strifor’s Offerings

On the surface, Strifor presents itself as a modern, trader-centric brokerage. But when you look closer, every “feature” feels carefully engineered for manipulation.

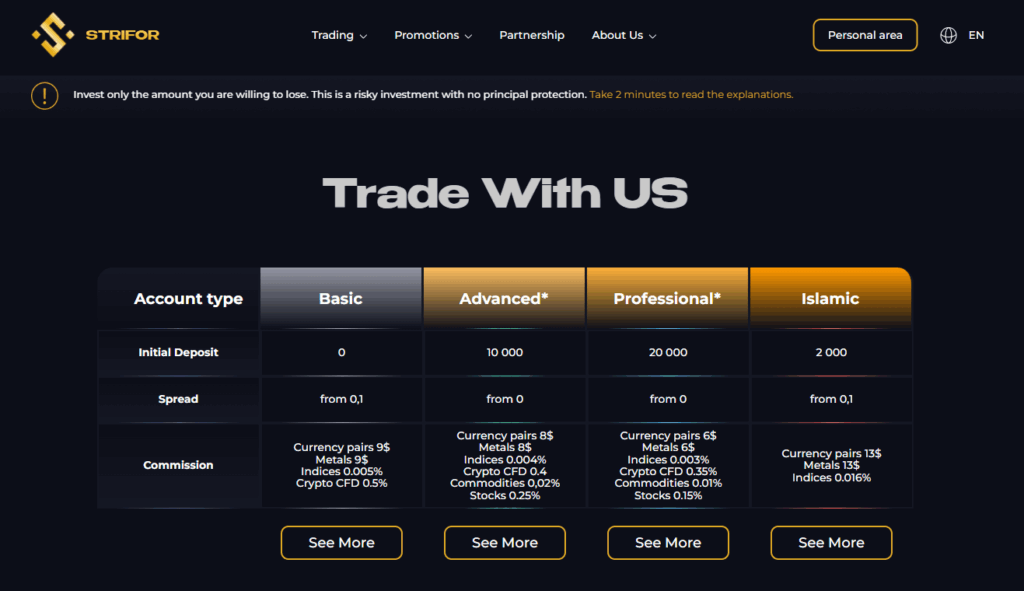

The Account Ladder Strifor: A Path Designed for Loss

The range of Strifor account types isn’t about catering to your needs; it’s a psychological ladder urging you to deposit more. It starts with a deceptively low Strifor minimum deposit, often as little as $10. This is the “foot-in-the-door” technique. The risk feels minimal, so you take the plunge. What follows is an upsell marathon. Account managers will soon contact you, praising your “potential” and strongly recommending you upgrade to access better conditions—namely, even more insane levels of Strifor leverage. And that leverage is the killer. Offering 1:500 or 1:1000 isn’t a generous gift; it’s a loaded weapon placed in the hands of an inexperienced trader. It guarantees that market noise can wipe out an account in seconds, turning what should be a minor loss into a catastrophic margin call. This isn’t a service; it’s sabotage.

The Social Trap in Strifor: Copy Trading and Affiliate Incentives

Two of their most promoted features, Strifor copy trading and the Strifor affiliate program, are particularly cynical.

All about the Strifor affiliate program

The copy trading system, a central feature of the Strifor platform, presents a polished gallery of “successful” traders for you to follow. However, a deeper look reveals a disturbing pattern. Countless Strifor real reviews describe a common experience: users who followed these seemingly elite performers were led directly into massive, inexplicable losses. The inescapable suspicion is that these top-ranked accounts are not trading geniuses, but are either entirely fictional profiles or are executing manipulated, high-risk strategies designed to ultimately fail, systematically draining the capital of everyone who follows them.

This deceptive ecosystem is further amplified by Strifor’s aggressive affiliate program, which effectively turns victims into unwitting accomplices. By offering lucrative commissions for recruiting new clients, Strifor creates a self-perpetuating network of incentivized individuals. These affiliates, often trusting the platform themselves due to initial small withdrawals, become the most convincing advocates for the Strifor fraud. They are financially motivated to overlook the glaring red flags and to persuade their own friends and family to invest, deepening the pool of victims.

The Heart of the Matter: The Systematic Strifor Withdrawal Problem

This is where the friendly facade crumbles completely. The single most common thread in every Strifor complaint, the unifying cry across forums and review sites, is the absolute nightmare of Strifor withdrawal.

The process follows a predictable, almost scripted pattern of obstruction:

The Bait (Small Wins & Quick Payouts)

Initially, everything appears seamless with Strifor. Many users report that their first few withdrawal requests for small amounts are processed promptly and without any issues. This is not a coincidence; it is a critical phase in Strifor’s confidence trick. By successfully processing these initial withdrawals, Strifor systematically builds trust and dispels any early doubts. You find yourself thinking, “See? They are legitimate. The negative reviews must be from competitors or people who didn’t follow the rules.”

This carefully crafted illusion of reliability is designed to lure you into a false sense of security, encouraging you to invest more substantial sums before the real problems begin.

The Switch (The Profitability Threshold)

The problems begin the moment you cross an invisible line. This usually happens in one of two scenarios:

- You become consistently profitable and your account balance grows significantly.

- You request a withdrawal of a substantial amount, often your initial capital plus a large chunk of profits.

This is the trigger. You are no longer a “mark”; you are a liability.

The Maze (Delays, Demands, and Excuses)

Once triggered, you enter the maze. Your withdrawal request will not be processed. Instead, you will be met with a relentless barrage of obstacles:

- The “Enhanced Verification” Loop: You’ll be asked for documents you’ve already provided, or for new, increasingly intrusive ones. A selfie with your passport and today’s newspaper? It happens.

- The “Technical Glitch” Gambit: The payment system is “down for maintenance.” There’s a “bug” affecting withdrawals. The finance department is “experiencing delays.”

- The “Terms of Service” Accusation: This is a classic. You’ll be told your trading strategy constitutes “bonus abuse,” “price manipulation,” or violates some other obscure clause buried in the user agreement. Your profitable trades may even be retroactively canceled.

The message in every Strifor negative reviews is the same: Strifor does not pay once you’re successful. The evidence is overwhelming and consistent. This isn’t isolated incompetence; it’s company policy.

Behind the Curtain: The Anatomy of a Strifor Fake Broker Operation

threat. However, evidence strongly suggests that Strifor broker operates as a “bucket shop” or a scam.

In this model, they are not routing your trades to the real market. They are the counterparty to your every trade. Your loss is their direct profit. Therefore, when you win, they lose. For an unregulated, Strifor fake broker, the simplest and most profitable solution is to simply refuse to pay you. The Strifor withdrawal issues are not a bug in their system; they are the system.

The professional-looking Strifor trading platform (MT5) is just the bait in the trap. It provides the illusion of a real trading environment while the entire operation is rigged against you from the start.

Real Strifor Complaints

You don’t have to look hard to find people saying “Strifor cheated me.” The online landscape is littered with their stories.

One user on a major forex forum detailed how after growing a $1,000 account to $7,500, his withdrawal was held for months. He was eventually told his account was “flagged for arbitrage trading” and his balance was confiscated. His final words: “They are thieves. Do not trust them.”

Another Strifor complaint from a European trader described providing over a dozen different documents for verification, each one “not quite good enough,” until he simply gave up, writing off his $2,500 as an expensive lesson.

These are not rare occurrences. They are the predictable outcomes of dealing with an operation that has perfected the art of the Strifor scam.

Is There Any Hope for a Strifor Refund?

The desperate question every victim asks is about a Strifor refund. The hard truth is that recovering funds from an unregulated entity is an uphill battle. They operate from jurisdictions designed to protect them, not you.

If you find yourself in this situation, your options are limited but not nonexistent:

- Document Everything: Keep a meticulous record of all communications, transaction IDs, and screenshots.

- Formalize Your Complaint: Submit a formal Strifor complaint through their system, creating a paper trail.

- Report to Authorities: File reports with your local financial regulator, police cybercrime unit, and consumer protection agency.

- Chargeback: If you used a credit or debit card, contact your bank immediately to initiate a chargeback process, stating you were a victim of fraud.

However, the single most effective strategy is prevention. The best way to avoid the Strifor withdrawal problem is to never give them your money in the first place.

The Final Word: A Scam Wrapped in a Platform

Any objective Strifor review that looks beyond the marketing must conclude that this is a predatory operation. The combination of zero meaningful regulation and an avalanche of identical horror stories about Strifor not paying clients is a five-alarm fire.

The promise of easy profits is a lure. The professional platform is a prop. The friendly account managers are actors. The entire operation is a carefully staged play designed to convince you to hand over your money, only to discover that Strifor not withdrawing money is their core business principle.

Protect your capital. Protect your sanity. Steer clear of Strifor. Your financial future deserves a legitimate partner, not a battle to get your own money back.

Please sign in to your account to leave a review